A Newport law firm is urging families to plan ahead to reduce inheritance tax.

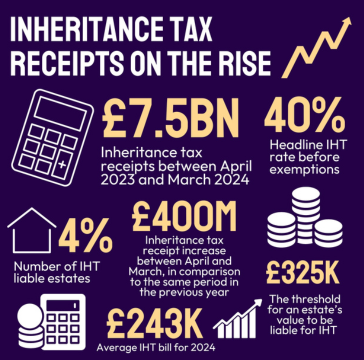

Latest figures from HMRC show that inheritance tax receipts have risen by 7.2% since last year.

By taking advantage of available tax reliefs and planning carefully, families can make sure their loved ones pay the smallest tax bill possible and get the most out of what they inherit.

The Association of Lifetime Lawyers represents a community of the most qualified legal professionals in the UK supporting vulnerable and older people with expert advice and support.

Claire Davis, Specialist Consultant at Newport law firm Bellavia & Associates, and the only Welsh director of the Association of Lifetime Lawyers, says there are precautionary steps to take if you plan for family members to inherit part, or all of your estate upon your passing.

Claire said:

“With more estates than ever liable for inheritance tax (IHT), it’s crucial to plan ahead to avoid a large tax bill for your loved ones. If the value of your estate is below the current nil rate band allowance of £325,000, no IHT is owed, provided the allowance hasn’t been reduced by relevant lifetime gifts.

“For married couples or civil partners who leave their entire estate to each other, HMRC permits the full transfer of the nil rate band to the surviving partner, effectively doubling the allowance to £650,000. Even if only a part of the estate goes to the spouse, the unused portion of the nil rate band can still be transferred upon the death of the second spouse.

“If your estate includes a business or related assets, at present, additional reliefs currently apply at rates of either 50% or 100%. Likewise, certain agricultural properties, such as land used for rearing animals or growing crops, can pass free of IHT, provided specific criteria are met.

“Creating a will is essential to ensure your assets are distributed to your chosen beneficiaries. Without a valid will, your estate will be divided according to the intestacy rules, which may result in your family not receiving what you intended.”

Research from The Association of Lifetime Lawyers shows nearly half of UK adults (49%) do not have a will. It’s important to consult a legal professional to help you draft a will.

Zep Bellavia, Managing Director at Bellavia & Associates, said:

“Given the recent change in Government, we’d recommend keeping an eye out for any potential policy changes and speak with a Lifetime Lawyer like Claire to help minimise your tax bill.”

For more information about Bellavia & Associates, please visit www.bellavia-associates.com, email info@bellavia-associates.com or call 01633 450460.